EMBRACING CHANGES

MEDICARE &

HEALTH INSURANCE

15

long years of helping families put love into action

|

50,000+

Happy Families

MAKING A DIFFERENCE

THE ENSURANCEMAX DNA

EXPERT STAFFING

PROVIDES BEST OPTIONS

ALWAYS AVAILABLE

MEETS YOUR NEEDS

AGENT

NOAH EDWARDS

Our agents at EnsuranceMax are dedicated to helping clients understand their eligibility for Medicaid and the benefits of enrolling in a D-SNP. We guide our clients through the application process for Medicaid and help them leverage the comprehensive benefits of D-SNPs to manage both their health care needs and other life aspects, such as housing and utility costs. Our goal is to ensure that our clients can utilize their health plan to not only treat medical conditions but also improve their overall life quality, recognizing that health is influenced by a wide array of personal and environmental factors.

Helping you understand

What is Medicare & Health Insurance?

Medicare is a federal health insurance program primarily for people aged 65 and older, but also available to some younger individuals with disabilities or specific medical conditions. It covers hospital care, medical services, and prescription drugs. Medicare generally covers 80 percent of approved medical costs, and you are responsible for paying the remaining 20 percent.

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. It can also cover other health-related costs such as prescription drugs, preventive care, and mental health services.

Helping you decide

What are your options?

Individual / Family Insurance

Individual or family insurance is a health insurance policy that covers an individual and, potentially, their family members under one plan. These plans can be purchased independently from employers and often include a variety of coverage options tailored to individual or family health needs.

Group Insurance Plan

Group insurance is a health insurance plan provided by employers, associations, or other organizations to their employees or members. It often benefits from lower costs due to risk being spread over a large number of participants.

Health Maintenance Organization

An HMO is a type of health insurance plan that requires patients to receive their healthcare from doctors and hospitals within the HMO's network. HMOs focus on preventative care and typically require patients to choose a primary care physician who coordinates their treatment and referrals.

Preferred Provider Organization

A PPO is a type of health insurance plan that offers more flexibility in choosing healthcare providers. It allows members to see any healthcare provider but offers better coverage for services obtained from its network of providers. Out-of-network services typically come with higher out-of-pocket costs.

Frequently Asked Questions

1. What is a PPO (Preferred Provider Organization)?

A PPO is a type of health insurance plan that offers more flexibility in choosing healthcare providers. It allows members to see any healthcare provider but offers better coverage for services obtained from its network of providers. Out-of-network services typically come with higher out-of-pocket costs.

2. What is a deductible?

A deductible is the amount you pay for health care services before your insurance plan starts to pay. For example, if you have a $1,000 deductible, you will need to pay the first $1,000 of covered services yourself.

3. What is coinsurance?

Coinsurance is the percentage of costs you pay after meeting your deductible. For example, if your insurance plan has 20% coinsurance, you pay 20% of the costs of a covered health care service, and the insurance pays the remaining 80%.

4. How are prescription drugs covered under health care plans?

Coverage for prescription drugs varies by plan. Most health insurance plans, including Medicare, have a list of drugs they cover, known as a formulary, which divides drugs into tiers based on cost. The tier a drug is on determines your share of the drug costs.

5. What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account available to people enrolled in high-deductible health plans (HDHPs). Contributions are made into the account by the individual or the employer and can be used to pay for eligible medical expenses, including deductibles, copayments, and coinsurance.

6. What is the Out-of-Pocket (OOP) Maximum?

The out-of-pocket maximum is the most you could pay for covered medical services in a year. After reaching this limit, your health plan pays 100% of the costs of covered benefits. This limit does not include your monthly premiums or any services your plan.

7. What are Medicare Supplements?

Medicare Supplements, also known as Medigap, are additional insurance policies that individuals can purchase from private insurance companies to cover the gaps in Original Medicare (Part A and Part B). These gaps include costs like deductibles, coinsurance, and copayments. Medigap policies help reduce out-of-pocket expenses and provide coverage for services that Original Medicare does not cover, such as medical care when you travel outside the U.S. Medigap policies are standardized into different plan types, each labeled with a letter, and each offers a different level of coverage. It's important to note that Medigap policies do not work with Medicare Advantage Plans and are only applicable to those who have Original Medicare.

8. What is Medicare Advantage

Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare (Parts A and B) offered by private insurance companies approved by Medicare. These plans provide all of the benefits covered under Original Medicare and often include additional benefits such as dental, vision, hearing, and health/wellness programs. Many Medicare Advantage plans also include Medicare Part D (prescription drug coverage). These plans may have different rules, costs, and restrictions, which can change each year. Medicare Advantage plans often require you to use healthcare providers within their network and may offer lower out-of-pocket costs compared to Original Medicare.

9. What can you do if you're not eligible for Medicare

If you are not eligible for Medicare, there are several alternative health insurance options available:

1. Employer-Sponsored Insurance: If you are employed, you may be able to enroll in health insurance provided by your employer. This is often a cost-effective choice as employers typically cover a portion of the premiums.

2. Marketplace Insurance: You can purchase health insurance through the Health Insurance Marketplace established by the Affordable Care Act. Depending on your income, you may qualify for premium tax credits and subsidies that lower the cost of coverage.

3. Medicaid: If your income is below a certain level, you may qualify for Medicaid, which is a state and federal program providing health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities.

4. Private Health Insurance: You can also purchase private health insurance directly from an insurance company. This might be a suitable option if you do not qualify for other forms of subsidized health insurance.

5. Short-Term Health Insurance: For temporary coverage, you might consider short-term health insurance plans. These plans provide coverage for a limited period, typically from a few months up to a year.

10. What should you do if you only have Part B of Medicare?

If you only have Medicare Part B, which primarily covers medical insurance for services like doctor visits, outpatient care, and preventive services, you might consider supplementing this coverage to ensure comprehensive health care protection. Here are some steps you can take:

1. Enroll in Medicare Part A: If you aren't already enrolled in Part A, which covers hospital insurance, consider enrolling during the General Enrollment Period (January 1 to March 31 each year) if you are eligible. Part A covers inpatient hospital stays, care in skilled nursing facilities, hospice care, and some home health care.

2. Consider a Medicare Advantage Plan: Medicare Advantage (Part C) plans are offered by private insurance companies and cover everything Original Medicare covers but can also include additional benefits such as dental, vision, and hearing coverage. This can be an excellent way to get a more comprehensive plan if you are only enrolled in Part B.

3. Explore Medigap Policies: A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs that Original Medicare doesn't cover, like copayments, coinsurance, and deductibles. It's important to note that Medigap policies generally don't cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing.

4. Review Prescription Drug Coverage Needs: If you need prescription drug coverage, consider enrolling in Medicare Part D. Although Part B covers some drugs administered during a doctor's service, most prescriptions you take at home require Part D coverage.

If you are only enrolled in Medicare Part A, which covers inpatient hospital care, skilled nursing facility care, hospice, and some home health services, you may want to consider expanding your coverage to include other necessary medical services. At EnsuranceMax, our agents are committed to helping our clients get everything they need for comprehensive coverage. Here are steps you can take:

1. Enroll in Medicare Part B: Consider enrolling in Medicare Part B during the General Enrollment Period or Special Enrollment Period, if eligible. Part B covers outpatient care, doctor services, and preventive services, which are not covered under Part A.

2. Medicare Advantage Plan: Explore Medicare Advantage (Part C) plans, which combine Part A and Part B, and often include additional benefits like prescription drugs, dental, vision, and hearing care. Our agents can guide you through selecting a plan that fits your needs.

3. Medigap Policy: If you wish to stick with Original Medicare, adding a Medigap policy can help cover additional costs such as copayments, coinsurance, and deductibles. Our EnsuranceMax agents can assist you in choosing the right Medigap plan that complements your existing Part A coverage.

4. Prescription Drug Coverage: Since Part A does not cover most prescription drugs, consider enrolling in Medicare Part D for prescription drug coverage. Our team can help you understand your options and ensure that your medications are covered.

11. How can D-SNP plans help pay for rent, utilities, and provide other benefits?

Dual Eligible Special Needs Plans (D-SNPs) are a type of Medicare Advantage plan specifically designed for individuals who qualify for both Medicare and Medicaid. These plans offer all the benefits of Original Medicare and often include additional coverage based on the individual's needs, which may not be covered by either Medicare or Medicaid alone. Here's how D-SNPs can help beyond traditional health care coverage:

1. Coverage of Non-Medical Expenses: D-SNPs can offer coverage for certain non-medical expenses that help improve health outcomes. For example, some plans may provide allowances for utilities or even help with paying rent if these factors impact the individual’s health conditions.

2. Flexibility in Benefits: These plans often include a flexible benefit allowance that can be used for various purposes, such as buying healthy groceries, paying for transportation to medical appointments, or covering utility bills.

3. Care Coordination: D-SNPs provide care coordination services to help manage health care, social services, and other needs. This can include assistance in understanding and utilizing plan benefits towards housing costs or utility payments if these are recognized as part of the individual's health needs.

4. Additional Health Services: Beyond primary health coverage, D-SNPs might cover additional services such as dental, vision, hearing, and wellness programs, which are not typically covered by Medicare.Prescription Drugs: Most D-SNPs include Medicare Part D prescription drug coverage, often with lower out-of-pocket costs.

5. Prescription Drugs: Most D-SNPs include Medicare Part D prescription drug coverage, often with lower out-of-pocket costs.

It's important to review the specific benefits offered by each D-SNP, as they can vary significantly based on the state and the provider. At EnsuranceMax, our agents are well-versed in the details of D-SNPs and are committed to helping clients understand how they can maximize these benefits to cover a wide range of needs, ensuring comprehensive care and support.

WHAT CAN WE GET YOU?

Request an Insurance Quote

MEDICARE

SUPPLEMENTS

MEDICARE

ADVANTAGE

PRESCRIPTION DRUG PLAN

DENTAL CARE

VISION

OUR MISSION

OUR VISION

Contact Information

EMAXONELIFE mission is to provide customized life insurance solutions that meet the evolving needs of individuals and families, ensuring their financial security and enabling them to live their lives to the fullest without worries about the future and loved ones.

EMAXONELIFE to be recognized as the most trusted and preferred life insurance company known for our customer-centric approach, financial expertise, and commitment to delivering superior value, nationwide and protection to our policyholders

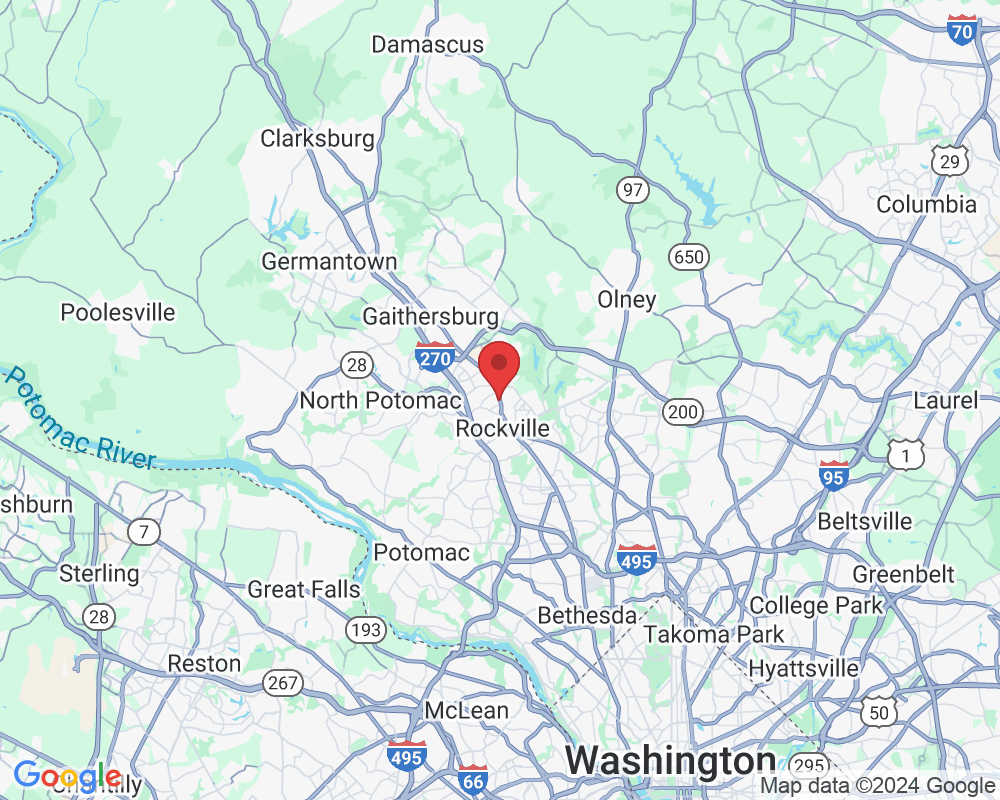

932 Hungerford Dr Suite 23B Rockville md 20850, Rockville, MD, United States, Maryland

+1 301-381-8339